Many Dare County property owners got a shock when they received their seven-year tax revaluations this week. Property assessments for some went up as much as 80 and 90 percent, sparking worries about what coming real estate tax bills might look like.

The alarm, local real estate experts say, is unwarranted. At least right now.

North Carolina is “revenue neutral” on property tax, meaning that local revenue brought in by property taxes in a reappraisal year would be approximately the same as if the reappraisal had not taken place.

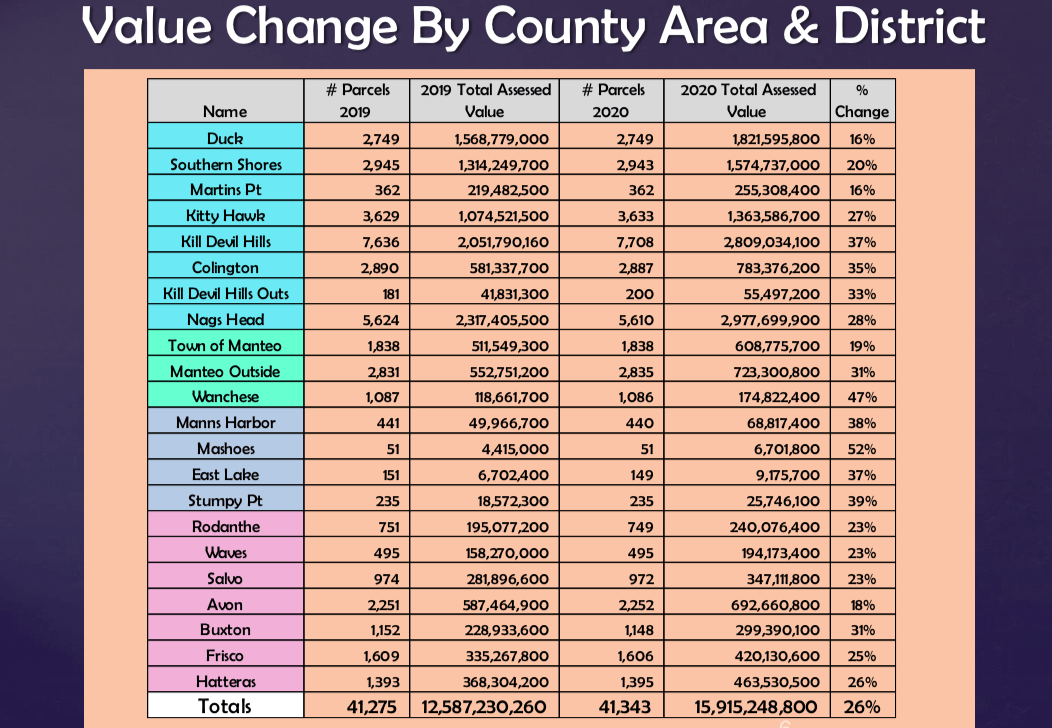

It’s been seven years since Dare County conducted a countywide property revaluation, something North Carolina jurisdictions are required to do every eight years. Dare County chose to advance the effective date from 2021 to 2020, resulting in a seven-year cycle.

Revaluation is a process of updating real property values to reflect their current market value. Market value is the most probable price a property would bring in an open and competitive market, according to Dare County’s webpage explaining the process.

“A new ‘revenue neutral’ property tax rate will be established by July 1st, we should know much sooner than that what the rate will be,” Outer Banks Association of Realtors CEO Willo Kelly said in a statement. “In the last revaluation; some land prices or home structure values went down, some went up slightly and some went up significantly. For those that saw a significant increase, they did see an increase in their total tax bill but not to the extent of applying the current tax rate to the newly valued amount.”

Property owners can appeal the new assessments online but Dare officials are encouraging owners to first utilize the comparable sales search links on the webpage below for vacant or improved residential properties.